Dame Alison Rose’s fate was sealed when reporters checking in with Downing Street and the Treasury were told the PM and chancellor had “significant concerns” about her conduct.

That communication – brief, unambiguous and deadly – was in contrast to the exchange with a journalist that ultimately cost Dame Alison her position as Britain’s highest profile female chief executive.

By Dame Alison’s account, her conversation with Simon Jack, the BBC’s business editor at a charity dinner, was informal, ill-informed and incomplete. It also turned out to be terminal as she effectively talked herself out of a job.

For Mr Jack the conversation produced what appeared a delicious scoop; Nigel Farage had been dumped by Coutts not, as he claimed, for his caustic political views, but because he didn’t have enough money.

That turned out not to be true, leaving Dame Alison under intense pressure when her attendance at the dinner with Mr Jack was revealed by a newspaper.

Coutts had in fact compiled a 40-page report including assessments of his political views and statements to justify a decision taken to ease him out as a customer. It called him a “disingenuous grifter” and worried that the perception he held racist and xenophobic views was incompatible with the bank’s values.

More fundamentally, it raised the prospect that the chief executive of a 38% taxpayer-owned bank had discussed confidential customer information with a journalist. Short of criminality it is hard to think of a more serious charge.

Dame Alison’s defence was that she did not know about the Coutt’s dossier when she spoke to Mr Jack – Mr Farage did not make it public until afterwards – and had been told back in April only that he was being dumped for commercial reasons.

She also insists that she did not disclose any financial information to Mr Jack, spoke only about what she believed was already on the public record, and discussed his eligibility for a Coutts account only “in general terms”.

When Dame Alison laid out her defence on Tuesday evening, accompanied by a vote of confidence from the board, it appeared thin and the directors’ endorsement hasty, and left her fate in the hands of ministers. She lasted barely seven hours.

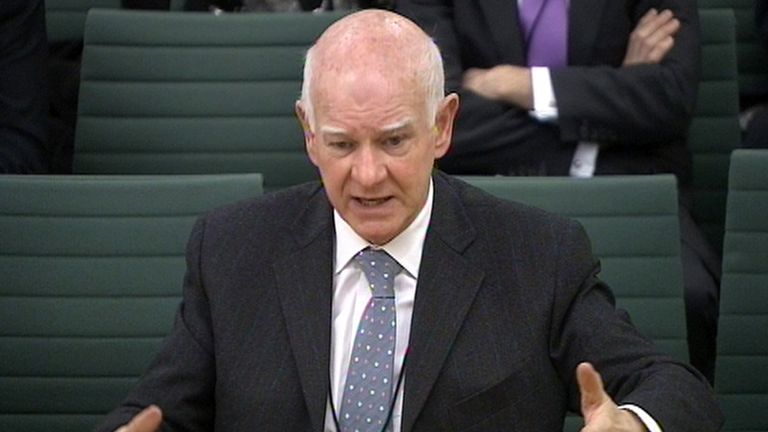

Remarkably the chairman Sir Howard Davies appears not to have checked with No10 or the Treasury, representing the taxpayers’ interest as shareholders, whether they would back Dame Alison’s position.

If there was any hesitation in Downing Street at decapitating NatWest, it did not last long. The appearance of political vetting by banks has caused concern among ministers and MPs, many of whom share Mr Farage’s view that it is evidence of “woke” culture in British institutions.

That perception may be the consequence of a deliberate attempt by NatWest and other banks to demonstrate greater social purpose in the wake of the financial crisis, when their collective recklessness contributed to the financial crisis.

Having received billions in taxpayer bailouts they resolved to do better and be more socially useful. Insiders at NatWest say that goal was genuinely held and pursued by Dame Alison, who knew that the taxpayer’s stake brought greater responsibility.

It’s notable that while the bank has apologised twice to Mr Farage, for their processes and Dame Alison’s conduct, it has not said sorry for wanting to end his Coutts account. It still maintains that it was a commercial call, informed by reputational risk, a judgment that has backfired spectacularly.

Read more:

BBC apologises to Farage for inaccurate report

Key points from Coutts’ dossier on Farage

Having cut her loose, the chancellor and PM may now be criticised for intervening more aggressively on this issue than when NatWest and others have faced accusations of more egregious wrongdoing.

Their political calculation will have practical consequences.

Under Dame Alison, NatWest recorded its largest profits since 2008 making it easier for the state to sell down its stake, reduced below 40% earlier this year. The search for a successor may slow that process.

Mr Farage meanwhile has accumulated more apologies than he apparently has bank accounts, but he would like to add more scalps too, starting with Sir Howard and the NatWest board.